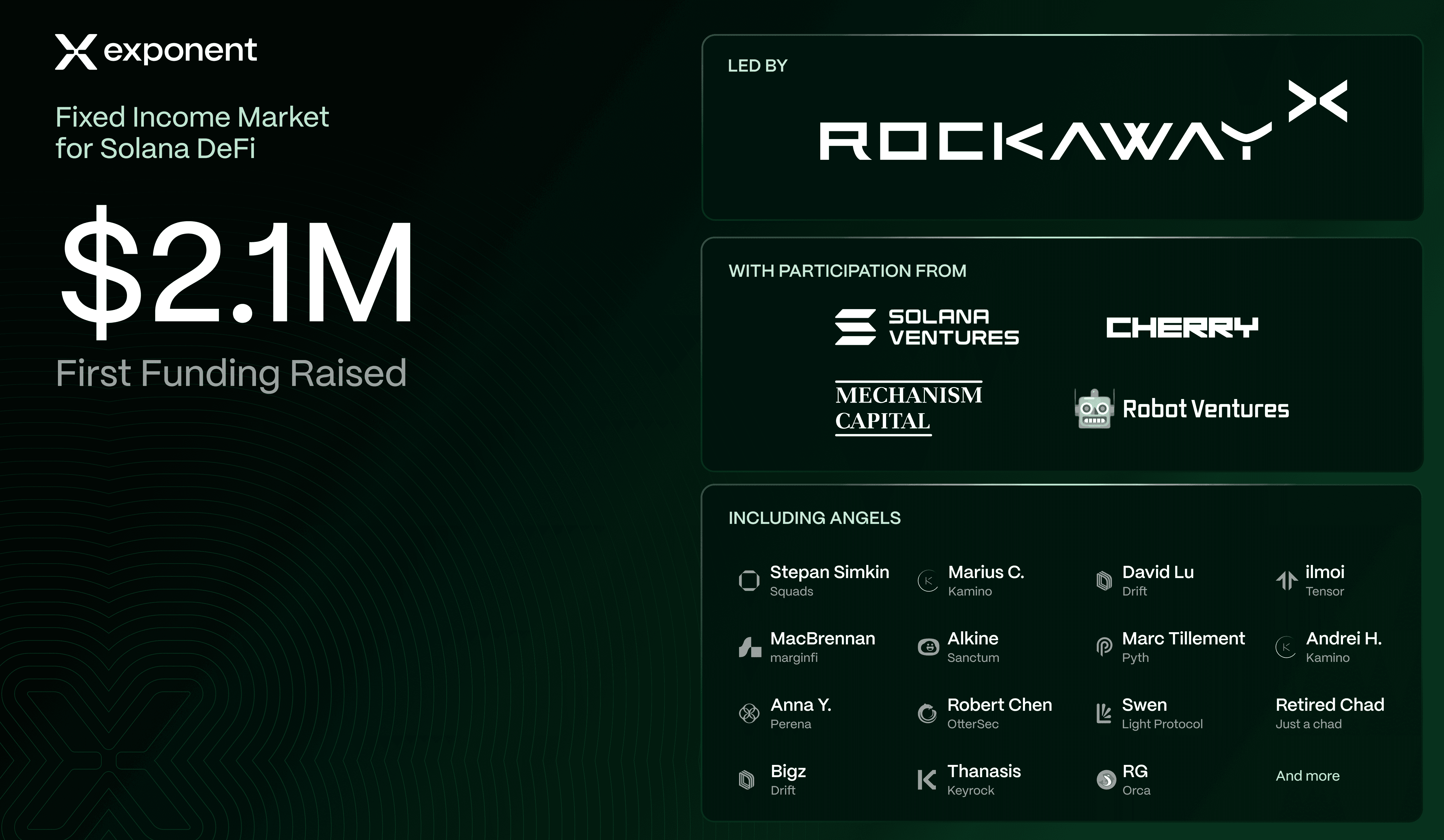

We are excited to announce our $2.1M fundraising round to bring fixed-rate markets to Solana DeFi.

The round was led by Rockaway_X, with participation from Solana Ventures, Cherry Ventures Crypto, Mechanism Capital, and Robot Ventures.

We are also grateful to have in this round an amazing group of founders, builders, and operators from the Solana ecosystem supporting us in our journey, including:

@simkinstepan (Squads)

@y2kappa (Kamino)

@davijlu (Drift)

@macbrennan_cc (marginfi)

@_ilmoi (Tensor)

@KemarTiti (Pyth)

@gizmothegizzer (Perena)

@bigz_Pubkey (Drift)

@soutos_sol (Keyrock)

@NotDeGhost (OtterSec)

@swen_sjn (Light)

@timsamoylov (Banx)

@alkineee (Sanctum)

and more.

Exponent is Now Live on Solana

This announcement comes as Exponent officially launches on Solana mainnet. Exponent is a yield exchange protocol on Solana for fixed-rate and leveraged yield farming. Users can exchange their productive yield assets (e.g. Jito’s VRTs, lending positions, yield-bearing tokens) for a fixed return or amplified exposure to their yield.

Exponent has been built to enable anyone to take directional views on where they expect APYs from DeFi markets to be in the future (e.g. in 1 month, 6 months, 1 year, etc):

If you anticipate a decline in the APY, you can secure a fixed APY and protect against it.

If you expect a higher realized APY, you can maximize your exposure to it and generate more returns.

Exponent’s flagship product, Income Tokens, introduces a new asset class to Solana DeFi. They allow participants to access fixed yields across Solana's yield lanscape regardless of market volatility.

Why Exponent?

We started building Exponent in early 2024 when we realized there was no way to access predictable yields on Solana or better manage exposure to DeFi yields.

The Solana DeFi ecosystem was exploding with new products, usage, and liquidity, yet participants were left with only variable yield options. While market conditions fluctuate, users should have access to yield products that aren’t solely dependent on market sentiment. Today, securing consistent returns in DeFi still requires time and effort.

Similar to how people balance crypto holdings between volatile assets and stablecoins, Exponent’s Income Tokens allow users to balance variable yield positions with stable yield positions—ideal for DeFi users looking for protection against yield downturns or wanting less active management of their positions.

On the other hand, users with minimal capital can increase their exposure to variable DeFi rates and/or speculate on their appreciation over a set time horizon.

After winning the @Colosseum hackathon, we’ve spent the past months refining Exponent’s core primitives and building a novel Solana AMM for this new class of fixed-term yield assets.

The Protocol

At its core the protocol issues yield assets with maturities, enabling directional views on DeFi rates.

This is powered by a yield stripping mechanism, which separates a DeFi product’s yield from its principal value, creating two tradable assets:

Income Token (PT) — fixed yield on principal: Represents the principal deposited into a DeFi product, locked until maturity. It trades at a discount, reflecting the remaining future yield being sold off, and reaches a 1:1 price with the principal at maturity, realizing a fixed return when claimed.

Yield Share Token (YT) — variable yield earned by principal: Represents the variable yield earned by the principal deposited in the DeFi product and sold off by Income Token holders. Its price reflects the remaining future yield distributed to 1 share of yield (for 1 principal) until maturity.

These tokens can be exchanged through Exponent’s AMM — a novel Solana-based AMM designed specifically for yield assets with maturities. Liquidity providers can supply liquidity to this AMM via Liquidity Vaults and earn additional yield on their productive assets through trading fees.

Explore Exponent on Solana Mainnet

Exponent is now live on Solana and double-audited by OtterSec and Offside Labs. The protocol offers a suite of yield-generating products for diverse needs:

Income – Exchange variable yields for fixed yield tokens and earn predictable returns at maturity. If you expect variable APYs to decline or look for passive management.

Farm – Leverage exposure to variable yields and protocol points by buying yield share tokens at an Implied APY. If you believe the current implied APY is undervalued and the underlying APY will realize higher yield at maturity.

Liquidity – Earn extra yield on your productive assets by supplying them into Liquidity Vaults and providing liquidity to yield markets, with minimal impermanent loss if held to maturity. If you are neutral on where APYs will be at maturity.

Get started at exponent.finance

Join the Community

We’ve just opened the Exponent Telegram community channel. Join for guides, discussions, and to get answers to your questions: t.me/exponentcitizens

For a deeper dive, check out our docs: docs.exponent.finance