Meteora Dynamic Pools are now supported on Exponent, kicking off with Meteora LP (MLP) USDC-USDT.

As a Meteora liquidity provider, you can now get a fixed APY on your LP position or leveraged exposure to MLP yield and points through Exponent.

What is Exponent

Exponent is a yield exchange protocol on Solana for fixed-rate and leveraged yield farming. Users can exchange their productive yield assets (e.g. Jito’s VRTs, lending positions, yield-bearing tokens) for a fixed return or amplified exposure to their yield.

Exponent has been built to enable anyone to take directional views on where they expect APYs from DeFi markets to be in the future (e.g. in 1 month, 6 months, 1 year, etc):

If you anticipate a decline in the APY, you can secure a fixed APY and protect against it.

If you expect a higher realized APY, you can maximize your exposure to it and generate more returns.

What is MLP

Meteora Dynamic Pools are full-range LP positions earning trading fees from active capital and lending yield from idle assets in the pool

Meteora USDC-USDT LP is fungible into MLP tokens, enabling liquidity providers to make their position productive across DeFi

How to use Meteora LP tokens on Exponent

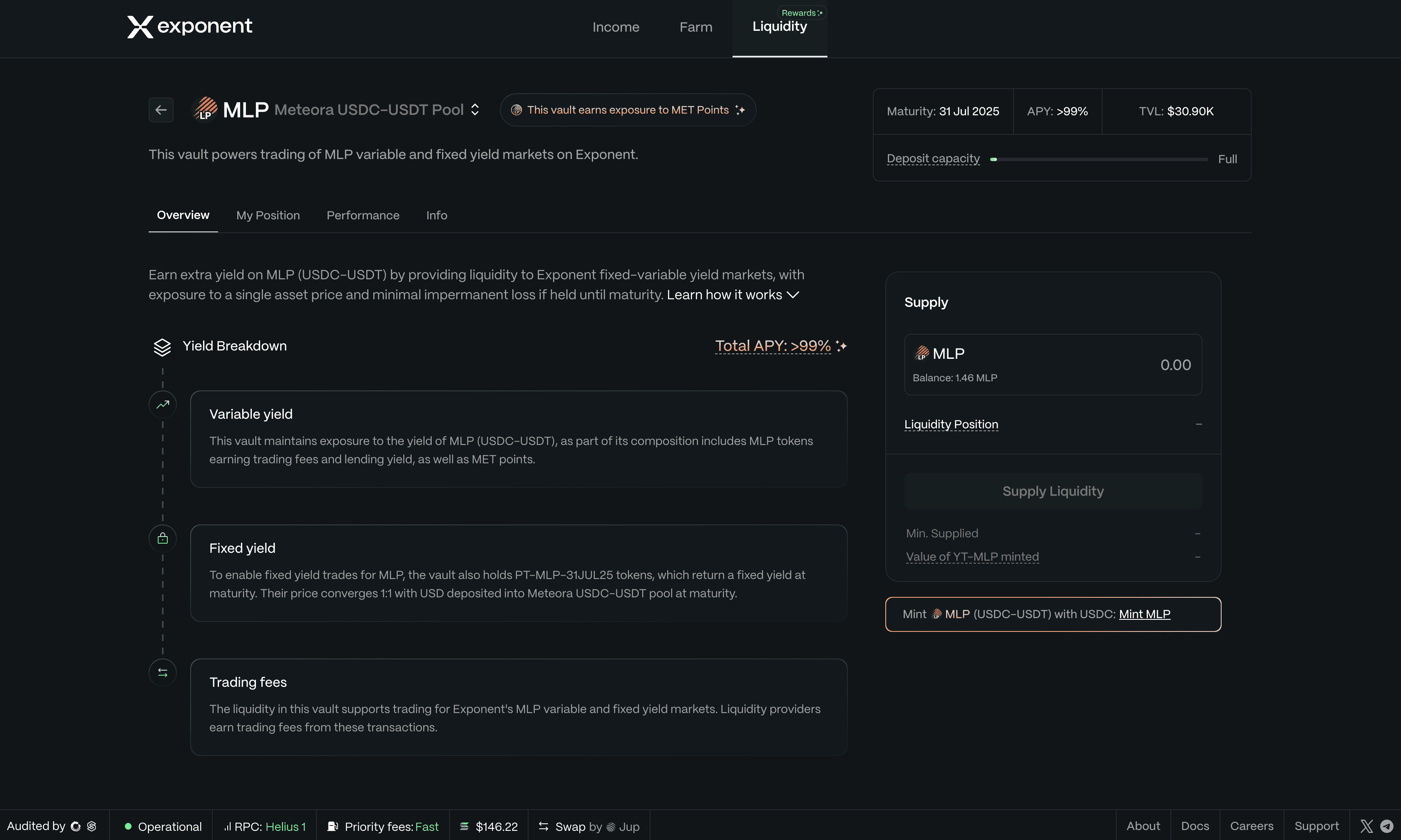

Liquidity - Earn extra yield on top of MLP fees

Supply MLP (USDC-USDT) into the Exponent yield market and earn dual exposure to variable & fixed yields with minimal IL.

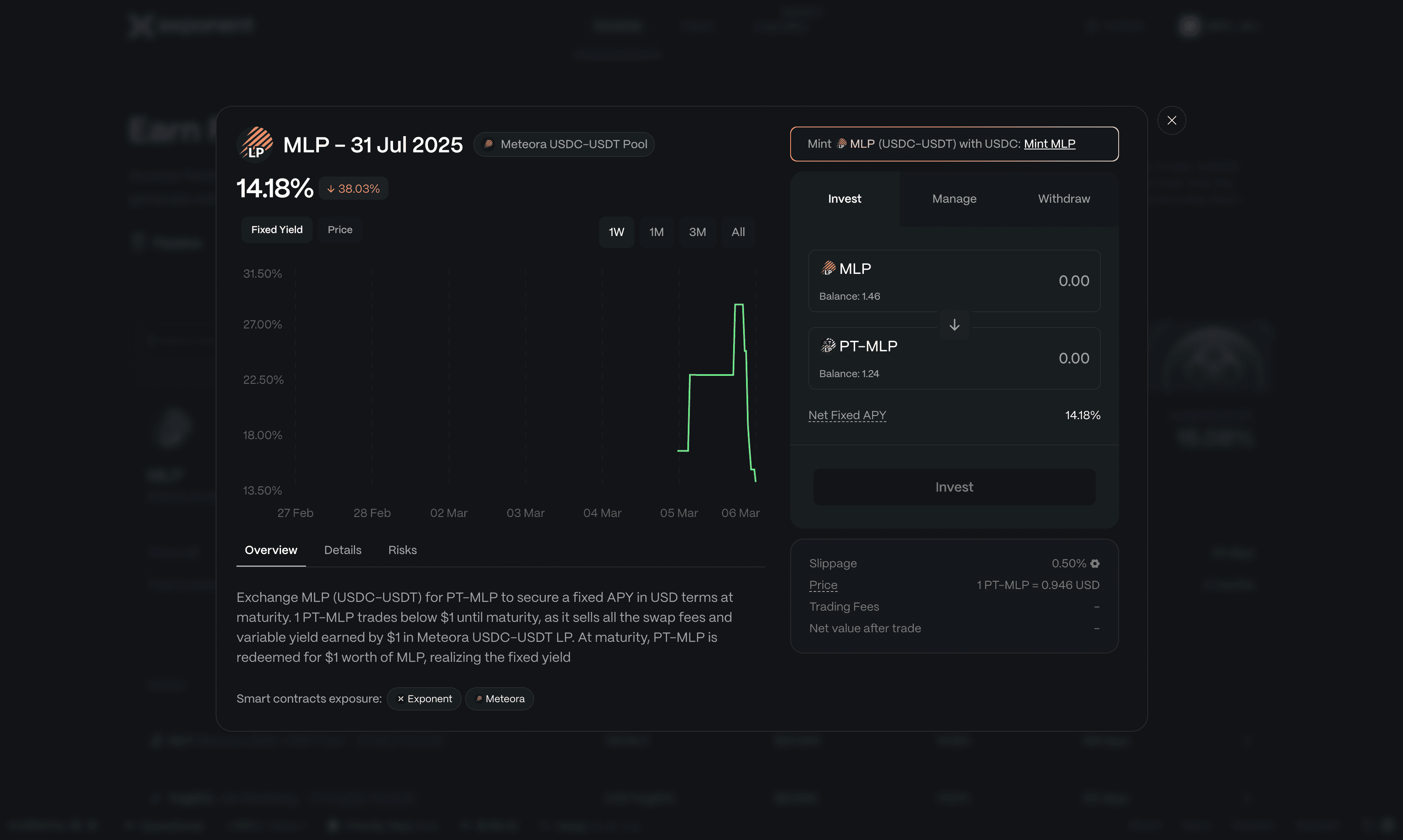

Income - Secure a fixed APY on MLP trading fees if they expect volume to go down

Exchange MLP yield and points for a fixed return at maturity with PT-MLP.

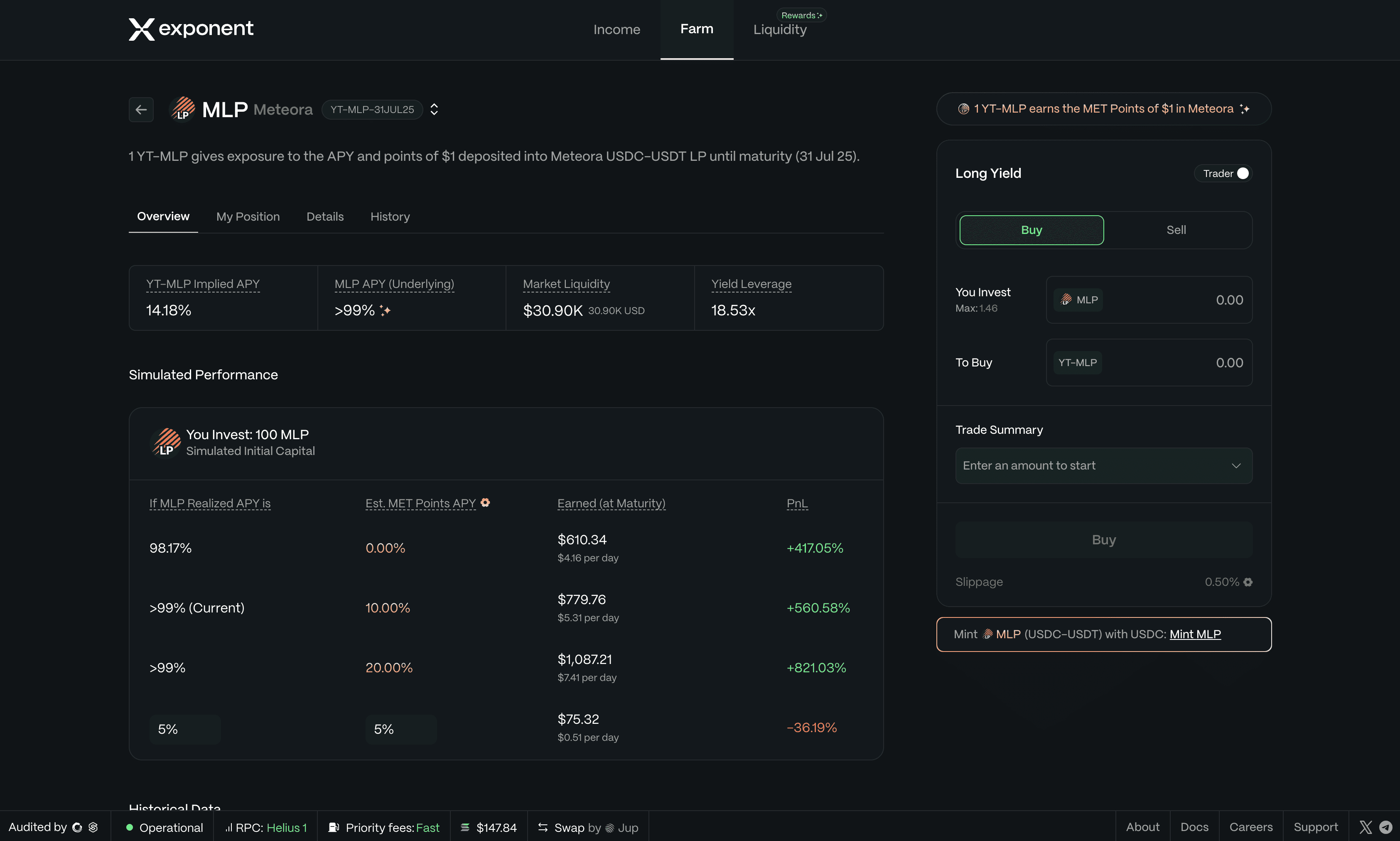

Farm - Go long and get leveraged exposure to MLP fees + points

If instead you wish to get higher exposure to MLP yield and points, exchange MPL for YT-MLP at a determined implied APY. You want to generate more from the APY and points earned by YT-MLP than what you spent to buy it.

Get Started

Get started now at exponent.finance/liquidity/meteora-mlp-31Jul25

For any questions, join the Exponent community: t.me/exponentcitizens.